As the global shortage of semiconductor processing chips shows no signs of easing, the global auto and technology industries will continue to be affected by 2022. Passenger cars typically use around 1,000 types of semiconductors. The automotive sector is not the largest market for semiconductor manufacturers. Inventory is sufficient and those who buy chips from internal manufacturers are less affected. The semiconductor shortage has already hit the company.

The insufficient supply of semiconductors is a key component that provides quiet power for modern infotainment systems, driver assistance equipment, and multiple electronic components. The problem stems from the surge in demand for personal computers, tablets, and smartphones during the peak of the COVID-19 pandemic, which has largely diverted supply from the auto industry. Passenger cars generally use around 1,000 types of semiconductors, and any slowdown in the supply chain means that manufacturing operations may come to a halt. Furthermore, like many countries, India is too dependent on Taiwan, the world’s largest supplier of microprocessors.

Also see: 2021 Mahindra Thar audit, detailed review

In this article

Taiwan, the world’s semiconductor factories:

The automotive industry primarily purchases its semiconductor chips (microprocessors) from major global manufacturers such as NXP Semiconductor, Infineon, Intel, STMicroelectronics, and Texas Instruments (TI). Most of the chipmakers are just one of the “overly reliant on” major manufacturers – Taiwan Semiconductor Manufacturing Company (TSMC) – the world’s largest semiconductor foundry. TSMC is understood to have a production capacity of around 12 million microchips.

According to Satish Sundaresan, vice president, and general manager of Elektrobit India, the automotive software division of the tier-one giant Continental, “If we look at TSMC’s financial performance, its auto revenue is less than one-fifth. Obviously, from a business perspective suppliers Looking at it, the automobile is not its biggest market, and the auto industry is not its last buyer of semiconductors. Therefore, the profit margin in this field is different (low).

semiconductor, automobile industry [Industry] The manufacturing cycle time is also very different, for example, the production cycle from silicon ingots to silicon ingots is also very short. Sundaresan said that the lifespan of the ECU is months instead of weeks. “Unfortunately, the close of last year This means that people are not buying cars, forcing car companies to drastically review their production plans.” At home, the demand for consumer electronics such as laptops, Mobile phones, and back-end Internet data centers is increasing rapidly.

He added: “All chipmakers like TSMC must readjust existing inventories.” However, as the lockdown period has moderated in the second half of 2020, and car sales closely follow the recovery curve in the form of V, this is mainly due to the accumulation of demand. As well as the growing demand for safer personal transportation, the auto industry is I don’t know anything about it. Carmakers in the UK, Germany, and India are struggling to maintain production plans due to a lack of semiconductor-based electronic components such as ECUs, infotainment systems, and sensors. Ask the chip manufacturer for help, just because in terms of cycle time, we are talking 4-6 months, which is not easy. Also, this is the reason for the current state of the industry. Sundaresan said.

Automakers with instant workflows were affected:

About ten years ago, during the financial crisis of 2008-09, the global auto industry learned its lessons and allowed chipmakers to keep reasonable amounts of inventory, but at less than Toyota existed. this is not fast enough. Sundaresan said: “As a result, even the largest automakers that continue to rely on the just-in-time (JIT) concept will not be able to buy chips during the pandemic.” Some manufacturers are believed to have made alternative acquisitions.

Japan’s semiconductor companies, such as Renesas and ROHM Semiconductor, have their own foundries. However, those who have been waiting for the global supply chain to resume smooth operations are now witnessing slowdowns in production and even factory closures. According to Sundaresan, the situation has not yet fully stabilized. Although some Indian manufacturers are struggling, the second phase of the national lockdown has helped overcome this to some extent. We can say with certainty that it is getting better and better, actually much better than it was in January 2021. However, the problem still exists, he concluded.

The macro function of the microprocessor:

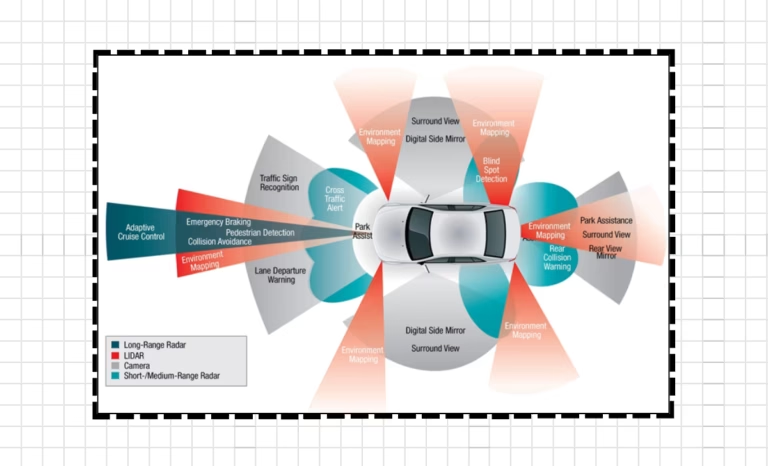

Semiconductors are an indispensable part of modern automobiles, ranging from passenger cars to buses and even two-wheelers. From driving basic elements (such as digital radio tuner, electronic power steering, and exterior mirror control) to complex mechanisms (such as LED lighting, telematics, and V2X communication for ADAS functions), these microprocessors are have become the core of the vehicle and increasingly transform it into an intensive electronic project.

With the shift from automobiles to computers on wheels, microprocessors and semiconductors have driven this change. Furthermore, with the popularization of electric vehicles, these semiconductors will further enhance their function and become deeply integrated into the car’s neural network, powering what appears to be the core feature set of the vehicles of the future.